Since Swish has a near monopoly on instant phone payments in Sweden, banks must set fees independently to ensure competitive pricing. Companies and registered organisations pay around 1–3 SEK (depending on bank) per received payment in addition to a small yearly fee, and are not allowed to charge the customer for their Swish fee.

#SWISH PAYMENT APP FREE#

The service is free for private users since the start 2012. As such, Swish is used for transactions that used to be mostly cash-based. Prior to the implementation of Swish, cash was the primary means for many of these types of real-time transactions. It is possible to pay by scanning a QR code. In January 2017 Swish was launched for web based sales which quickly became popular, for example used by the train operator SJ. In 2014 organisations could register for receiving payments, although some organisations used a private bank account of someone in the organisation before that. Small companies who wished to avoid credit card charges and simplify online payments soon followed suit. Swish was originally intended for transactions between individuals, but soon it started to be used for flea markets and collections at church services, and by sports clubs and other organisations as payment at small events where a credit card reader would be too expensive or otherwise impractical.

The actual transfer is done by the Bankgirot clearing system, which developed instant payments for the Swish system. The phone number can be of another country. Users who have a Swedish bank account but no suitable phone can register for reception only of payments. This requires that the user has a bank account in a Swedish bank participating in the system, and also a national ID number. The user must have a second mobile application called Mobilt BankID Säkerhetsapp, which is an electronic identification issued by several banks in Sweden. The service works through a smartphone application, through which the user's phone number is connected to their bank account, and which makes it possible to transfer money in real time, a few seconds until confirmation is received by both parties. Swish is a member of the European Mobile Payment Systems Association.

It had 8 million users as of July 2022 (total Swedish population: 10.2 million). The service was launched in 2012 by six large Swedish banks, in cooperation with Bankgirot and the Central Bank of Sweden. Hinweis: Bitte beachten Sie, dass eine ReqID nur 12 Monate gültig ist, danach wird sie vom Paygate gelöscht.Swish ( Swedish pronunciation: or ) is a mobile payment system in Sweden. Einreichungen mit identischer ReqID auf einen offenen Status werden regulär verarbeitet. Der Status 3-D Secure Timeout gilt nicht als abgeschlossener Status, bei dem ReqID-Funktionalität am Paygate nicht greift. Dies gilt nicht für 3-D Secure Authentifizierungen, die durch einem Timeout beendet werden. Falls die Transaktion oder Aktion mit derselben ReqID erneut eingereicht wird, führt das Computop Paygate keine Zahlung oder weitere Aktion aus, sondern gibt nur den Status der ursprünglichen Transaktion oder Aktion zurück.īitte beachten Sie, dass das Computop Paygate für die erste initiale Aktion (Authentifizierung/Autorisierung) einen abgeschlossenen Transaktionsstatus haben muss. durch ETM) zu vermeiden, übergeben Sie einen alphanumerischen Wert, der Ihre Transaktion oder Aktion identifiziert und nur einmal vergeben werden darf.

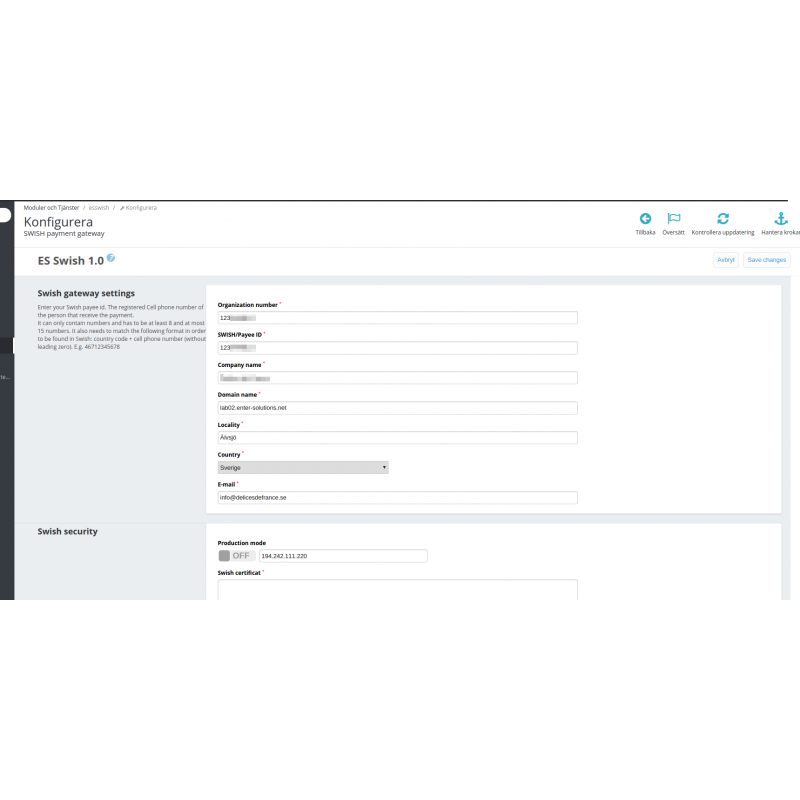

Sie muss auch folgendem Format entsprechen, um von Swish gefunden zu werden: Ländercode + Mobiltelefonnummer (ohne führende Null). Sie darf nur Ziffern enthalten und muss mindestens 8 und maximal 15 Stellen haben. (Pflicht, wenn Channel = Web)ĭie eingetragene Mobiltelefonnummer der Person, welche die Zahlung vornimmt.

#SWISH PAYMENT APP CODE#

In order to get found by Swish, it also must comply with the following format: Country code + Mobile telephone number (without leading Zero). Only digits are allowed and it must have at least 8 digits and maximal 15 digits. The submitted mobile telephone number of that person that makes the payment. Kanal, über den die Zahlung abgewickelt werden soll.Ĭustomer’s mobile telephone number.

0 kommentar(er)

0 kommentar(er)